The SCF Turgut oil tanker owned by Sovcomflot, a Russian state-owned shipping company © Sovcomflot

We merrily pump it into the fuel tanks of our vehicles without really giving a thought to where it comes from. We should, perhaps, stop and think. After all, oil, or petroleum, originates from long dead plants and microorganisms that were, over the course of millennia long past, buried under layers of sediment. Trapped there, and subjected to enormous heat and pressure, they were turned into hydrocarbons, and thus into that useful and valuable stuff we call oil. Not for nothing do we refer to it as “a fossil fuel”, although it’s mainly composed of carbon and hydrogen, the universe’s commonest elements, as well as being among its most useful. As we all know (or should do) the universe is expanding, just as the American astronomer Edwin Hubble proved back in 1929, when he calculated that the velocity at which a galaxy is seen to move increases according to its distance from Earth. It became known (and still is known) as “Hubble’s Law”, although it had been first stated by Georges Lemaître, a Belgian Catholic priest, theoretical physicist and mathematician, two years earlier. It should really be known as “Lemaître’s Law”, I suppose. But I digress.

The plain fact is that it’s very valuable, if not exactly pretty, at least not in its liquid form, to which we’ll come later. It’s more appreciated when it takes the form of diamonds. Without carbon we could not exist. It helps to power the nuclear reactions of the Sun which give us heat and light, as well as providing the raw materials so vital to all sorts of things, from building materials to the clothes on our backs. Carbon comes in many forms and is the 15th most abundant element in our planet’s crust. But of course, the oil we use to fuel our vehicles and other things isn’t just carbon.

It also contains, as I mentioned earlier, hydrogen, the number one element in the periodic table of chemicals. It accounts for 88% of all the atoms in existence, so it’s hardly rare. Indeed, it’s what powers the Sun (and all the other stars, of course) and it’s responsible for the tan you get while lying out in its welcoming rays. There is a lot of hydrogen in the Earth’s crust, of course, in the hydrocarbons that have been formed from decaying organisms to become our modern fuels, turning into such wonders as crude oil and natural gas. Indeed, scientists now think that hydrocarbons may have been formed deep in the Earth, from methane that has been subjected to very high pressures and temperatures.

It’s such useful stuff, as well as being versatile to the point of ubiquity, that you might think people wouldn’t fall out over it. But, of course, they do. Humans can fall out over anything, but especially if it has a monetary value. And oil most certainly does. Russia is fortunate in being well-supplied with lots of the stuff. Many Western countries tried to block the purchase of Russian oil, because its sale helps to fund its aggressive activities in Ukraine, which many Western politicians would like to end. Western sanctions were supposed to damage the Russian economy, but they have, in reality, simply made it more difficult for it to sell its oil. As it is, Russian oil still flows into the EU (and elsewhere, of course), earning Moscow millions of euros. Despite all the sanctions, the EU paid some €140-billion for Russian oil and gas in 2022, including an impressive €80-billion for oil, according to a report in Britain’s Financial Times. That has helped to pay for the weapons Russia shoots at Ukraine.

Back in May 2022, a mere two months after Russia’s invasion of Ukraine had begun, European Commission President Ursula von der Leyen promised a complete import ban on Russian oil arriving by sea. That notwithstanding, witnesses have reported Russian oil tankers arriving in EU ports, especially in Romania and Bulgaria. We should not be surprised, nor even horrified. Trade and commerce are hungry for oil, so it’s a never-ending demand and businesspeople over the years have found innumerable ways around whatever restrictions are put in place. Needless to say the trade is not conducted openly and nor are tankers bearing Russian oil often seen in European ports. In one case, a Russian tanker was spotted off the Romanian coast near the port of Constanta before the arrival of the Panama-registered Melahat, which specialises in ship-to-ship transfers of oil: a useful way of disguising a cargo’s point of origin. It had clearly happened before and would do again. I need hardly explain that it was not the Russian-registered vessel that docked but rather the one listed as Panamanian. It happens quite a lot with the oil being transferred to a vessel registered in a neutral country that could bring the oil to shore and unload it without problems. It seems as if EU governments (or some of them) are quite happy to disguise the true origins of their oil supplies while Russia, of course, is very happy to find a safe market and to be paid. In 2023, it’s believed that one refinery processed almost 5-million tonnes of Russian oil, which brought the Kremlin almost a billion euros in direct tax revenue. When western governments talk about putting the financial squeeze on Moscow they are being somewhat disingenuous. They all want to get their hands on Russia’s oil and each other’s money.

Romania and Bulgaria seem to be favoured destinations for the stuff. The ships that carry it are known as the “shadow fleet”, or even the “ghost fleet” of ageing and frequently uninsured vessels, now responsible for carrying about a third of Russia’s oil exports. Back in 2023, Bulgaria passed a new law banning the import of Russian oil, but a ship-to-ship transfer only takes around 24 hours and safely offshore, out of the views of watchers. Once the stuff has been moved to a different vessel, who’s to say where it came from originally? Oil is oil and looks the same wherever it came from, a yellowish-brown liquid. In November 2024, according to Ukrainska Pravda, journalist Mykhailo Tkach watched two Russian oil tankers as they arrived at EU ports, albeit fairly minor ports. He saw them, one flagged in Liberia and one in Panama, carrying 160,000 tonnes of crude oil to EU ports after sailing from the Russian port of Novorossiysk. Ironically, he reported, the oil arrived on a day on which a Russian bombardment of Ukraine lasted for more than fifteen hours. So, when Vladimir Putin talks of peaceful solutions, he’s lying, of course.

One commentator noted that it’s easy to tell when Putin is lying: his lips are moving and there is sound coming out.

Tkach points out other examples of Russian duplicity to bypass bans and restrictions, all seemingly carried out with the covert blessing of Western governments (which they would deny, of course). He mentions another vessel, the Altai, registered in the Marshall Islands, which sailed from Novorossiysk in Russia to Constanta in Romania with a crew of 19 Russians and two Georgians, bringing crude oil to both Romania and Bulgaria. It docked at its European destination, the Romanian port of Midia, on the same day that Russia launched one of its biggest missile assaults on Ukraine, aimed at its energy sector, while Romanian tugs were towing the Altai a mere 10 kilometres off Romania’s coast. According to text messages sent to Ivan Bogdanov, a Russian sailor serving on the Altai, but intercepted by Ukrainska Pravda, the Altai had been anchored in Romanian waters for nearly a week before returning to Novorossiysk for reloading. According to Tkach, the texts show that the vessel’s crew were all well aware of what they were doing.

It seems that after sanctions were imposed in February 2023, more than five million tonnes of Russian oil, with a value of €3-billion, were shipped into Europe through Turkey. Turkey seems to have been playing as very significant part (if that’s an appropriate description) in Russia’s determination to break European sanctions while Europe’s nations have seemingly allowed it, happily turning a blind eye to what’s been going on.

You may be interested to learn that although tighter sanctions could slash the Kremlin’s income by 20% per year, they don’t because of all the profit-driven cheating that goes on, and imports of Russian oil currently exceed all the financial aid that we in the West have sent to Ukraine. Typical of politicians, eh? Promise one thing but actually do something totally different. Additionally, Putin is getting assistance of a sort from his pal, Donald Trump, who has refused to impose a price cap on Russian oil, as the EU would like. Furthermore, Russia has been benefitting from a spike in oil prices that results from Israel’s attack on Iran, which is itself a major oil producer. Of course, it’s revenues from Russian oil that underpin that country’s economy. However, Bloomberg reports that Washington will not back the move. Of course, it’s not all in the hands of the EU since it involves a wider range of countries, and EU plans to target Russian businesses and banking would require the support of all 27 member states, while effective economic action would require the support of all G7 nations, which would have to include a currently unwilling United States. At the same time Israel was launching attacks on Tehran, Putin was holding telephone calls with the Israeli Prime Minister, Benjamin Netanyahu and with the President of Iran, Masoud Pezeshkian. Israel has claimed that its attacks on Iran were aimed at preventing it from developing its own nuclear weapon, an ongoing project with a regrettable target to which it’s said to be getting close, or at least “closer”. According to Newsweek, in his call with Netanyahu, Putin reminded him of the risks of war. “The importance of resuming the negotiations and resolving any issues pertaining to Iran’s nuclear programme (must be conducted) exclusively via political and diplomatic means,” he said. In speaking to Pezeshkian, Putin is said to have “stressed that Russia condemned Israel’s actions, which had been carried out in violation of the UN Charter and international law.” The Institute for the Study of War, based in Washington, reckons that rising oil prices can only benefit Putin, helping Russia to fund its continued strikes on Ukraine and its global ambitions. It will help Putin to afford more weapons. The EU may try to impose its oil price cap without the United States, but there’s no doubt that a fear of hostilities between Israel and Iran is having a serious effect on oil prices.

It’s worth remembering that EU imports of Russian fossil fuels in the third year of its illegal invasion came to more than all the financial aid sent to Ukraine. In February 2025, Russia’s annual earnings were anticipated to reach around €237-billion. It makes continued sanctions more important than ever, according to centre-right Lithuanian MEP Rasa Juknevičienė, of the EPP group, “Sanctions are not just a policy tool; they are a strategic necessity,” she says; they must be maintained. “Now is the time to keep calm and carry on – holding firm against pressure to lift them. Easing sanctions prematurely would only strengthen authoritarian regimes and undermine the very principles we seek to uphold. Persistence is the key to real impact.” It’s also being argued that tighter sanctions could cut the Kremlin’s revenues by some 20% per year. If you want to hit someone where it most hurts, hit them in the pocket.

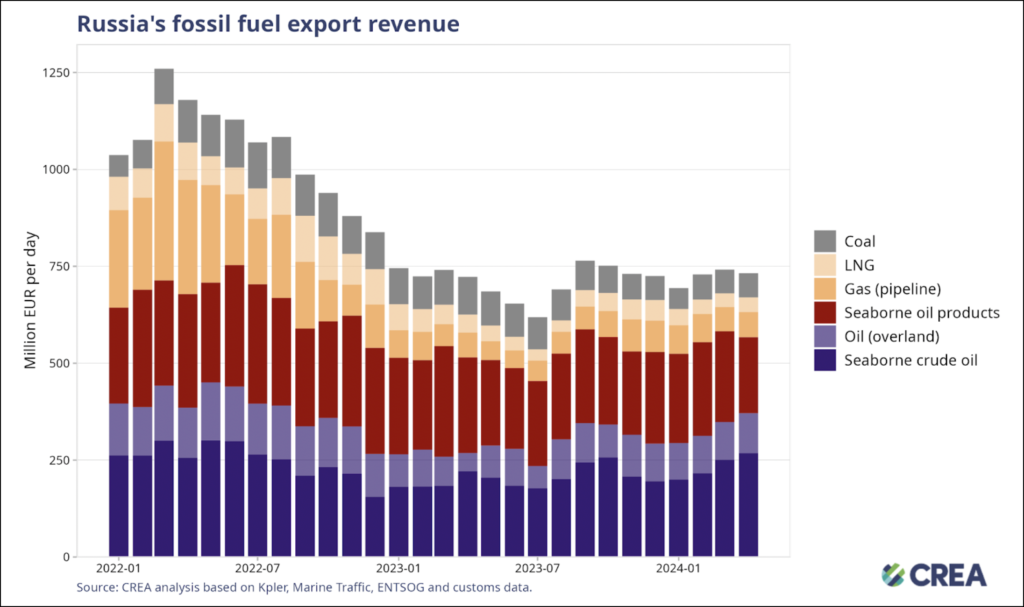

It may seem ironic that despite the various sanctions imposed, in this, the third year of Russia’s wide-ranging invasion of Ukraine, EU imports of Russian fossil fuels remain virtually unchanged, worth an annual €21.9-billion. That is, in fact, a 6% year-on-year drop in value but only a 1% drop in volumes. Certainly, the amount the EU spent on buying Russian fuels exceeded the €18.7-billion given in financial aid to Ukraine. The invasion has been going on for three years but Russia’s so-called “shadow fleet” continues to transport the oil Europe theoretically wants to block (but needs), re-routing it to countries that don’t impose sanctions. Russia’s earnings from selling its oil make interesting reading. In the year immediately before the invasion, the revenue reached €264-billion. In the first year of the actual invasion, that figure rose to €356-billion. The following year the figure fell to €250-billion and it fell again the following year to a “mere” €242-billion, in each case involving mainly crude oil, with gas as the next most important commodity while coal came last. Russia’s famous “shadow fleet” carried most of it, transporting 167-million tonnes or 61% of all Russia’s seaborne crude oil shipments.

Europe’s dependence on Russian fossil fuels has decreased since the invasion, but not by as much as you might think. Imports of Russian oil and gas may have gone down considerably – from 45% in 2021 to 18% in 2024 – but a quarter of Russia’s earnings from its exports of fossil fuels still come from Europe. Many people have said that it’s well past the time to change that, with the aim of completely eliminating any European dependence on Russia’s fossil fuels while investing heavily in greater energy efficiency and renewable energy. It sounds like a great idea, but Europe still needs ever-more energy and it will have to get it from somewhere. The current alternatives appear unlikely to meet demand.

Meanwhile, Russia continues to make billions from its valuable natural resource. Campaigners have argued that Europe and the United States must do more to prevent Russia’s oil and gas from fuelling the war with Ukraine. Oil and gas account for almost a third of Russia’s state revenue and form more than 60% of its total exports. According to the Centre for Research on Energy and Clean Air (CREA), Russia has made more than €883-billion from its fossil fuel exports since it first staged its invasion. Quite a lot of it, a surprising €209-billion came from EU member states. The volumes in transit are rising year by year, too. According to CREA the volume rose by 26.77% in January and February 2025 over the same period in 2024. Meanwhile, Hungary and Slovakia continue to receive Russian gas through a pipeline that goes via Turkey.

One of the authors of a report into Russia’s ongoing gas export business, Vaibhav Raghunandan put it plainly: “Purchasing Russian fossil fuels is, quite plainly, akin to sending financial aid to the Kremlin and enabling its invasion.” He also pointed out that it’s “a practice that must stop immediately to secure not just Ukraine’s future, but also Europe’s energy security.” In 2024, the EU spent 39% more on importing Russian fuels than it set aside to help Ukraine. That aid figure doesn’t include military or humanitarian contributions. An economist at IfW Kiel, Christoph Trebesch, has pointed out that there is a large gap between how much aid donors had raised for Ukraine when compared with previous wars, with European donors giving on average less that 0.1% of FDP each year. He said that Germany, to take one example, mobilised more aid and more quickly for Kuwait’s liberation in the 1990-91 conflict than it has for Ukraine over a comparable length of time. It’s also reported that according to one report Russia had earned €242-billion from exporting its fossil fuels during the third year of its full-scale invasion, with its revenues since the war began now getting close to a trillion euros. According to research for CREA, Russian oil revenues could be cut by around 20% if the current sanctions were properly applied and all the current gaps were to be plugged. EU ambassadors have agreed quite recently to tighten up the various restrictions, such as Europe buying oil that has been refined in a neutral country, as happens now, or restricting gas flows through the Turkstream pipeline, but Russia has become quite adept at bypassing the rules.

The report also called for a reduction in the use of liquified natural gas (LNG), which has grown dramatically since the Russian invasion and the subsequent war began. Russia has taken second place in the export of LNG to Europe since 2024. What’s more, Putin has an “unofficial” ally in Donald Trump, who uses his high office to stop the media from publishing critical stories. He’s not alone, either: the global threat to press reportage goes beyond Trump, who, along with Hungary’s Viktor Orban, would like to silence it and will continue their endeavours to silence it forever. Money in their pocket (however dishonourably acquired) seems to them far more important than the freedom and welfare of us ordinary people. Attempts to overcome those obstacles are under weigh, such as The EU authorities planning to require that European companies importing Russian gas will have to disclose the details of contracts in order to introduce clear restrictions on supplies by the end of this year and completely stop them by the end of 2027. Both France and Belgium have said they will challenge any such ruling, while Hungary and Slovakia are also expected to make an attempt to derail the plan.

In 2024, four countries imported 16.77 million tons of Russian LNG, according to the Kpler commodities platform, representing 97 percent of the EU’s total imports and more than half of Moscow’s global exports. Together, they spent more than €6-billion on buying the product. The ban would pose problems for Spain and the Netherlands too, although they’re unlikely to oppose it.

The EU is publishing a roadmap of its plan to end the import and sale of Russian gas completely by 2027, an idea that has been scorned in Moscow. Kremlin spokesperson Dmitry Peskov told Reuters that it would mean Europe “shooting itself in the foot”. EU member states have been asked to outline strategies for ending their reliance on Russia not only for oil but for uranium, enriched uranium and other nuclear materials. The EU hopes to move away from Russian gas by “enhancing energy efficiency, accelerating the deployment of renewable energy and diversifying supplies”, according to the European Commission.

We are entering uncharted territory. Nobody likes the idea of having to rely on the trustworthiness of Vladimir Putin whilst also shovelling money into his pocket, but neither does Europe want to be without oil and all the benefits it provides. How can that balance be struck? Nobody has really come up with a one-size-fits-all solution yet, but they will in time. The determination is there, but unfortunately so in Putin and, it seems, his chum, Trump. We know Trump likes oil and wants to seek more within the United States. You may recall that his campaign slogan for the last presidential election was “drill, baby, drill”. He said he wants to scale up oil and gas production whilst rolling back green alternatives, which he seems not to like. It means, I presume, that if he goes ahead he’ll be pumping more oil and gas, as long as his country continues to exist. Of course, if his actions lead to war, then lots of people will need to “drill, baby, drill,” and in uniform.