© Edm

As far as one can trace back, one of the earliest forms of alternative investment in modern history was the first American transcontinental railroad, built between 1863 and 1869, connecting Council Bluffs in Iowa to the Pacific Coast in San Francisco, California over public land. The project was financed through state and government subsidies or bonds – government loans that had to be paid back in time with interest – and awarded to two private construction companies, Central Pacific and Union Pacific.

In 1859, Theodore Judah, a civil engineer and the main promotional figure behind the American transcontinental railroad, went out looking for private funding and managed to convince four relatively unknown merchants in Sacramento, California, to invest in his project. The proposed railroad was to link the gold mines to the eastern seaboard of America, which was the hub of the economy in those days. The four merchants – Leland Stanford, Collis P. Huntington, Mark Hopkins and Charles Crocker – accepted the risk of investing their money in this long-term project that was not even close to starting, and even less to paying off anytime soon.

The project was a success. Ten years later in 1869, the transcontinental railroad was completed amid celebrations and wide press coverage. It was considered as the greatest construction project of its era and a key achievement in America with an immediate and positive impact upon the economy. Firstly, it reduced the time it took to travel across the country from six months to six days, and encouraged the growth of American businesses by allowing goods to be shipped from the isolated West Coast to the manufacturing-intensive East Coast much faster than before. Secondly, it created a production boom as resources from the mid and western parts of the United States were able to be used in production. Furthermore, it enabled tourism and immigration, as innumerable lives were spared among those attempting to cross the desolate lands through mountainous roads.

The four merchants who later came to be known as the big four, went to collect their money, allegedly laughing all the way to the bank.

Since those days, alternative investments have grown in popularity and have become more accessible; these have become the new normal in investing. An alternative investment is defined as any investment that falls outside the conventional long term asset classes such as stocks, bonds, currencies and commodities. In the 20th century, alternative investments included real estate, private debt, infrastructure, private equity / venture capital, hedge funds, equity crowdfunding and leveraged buy-outs, among others. Today, with investors’ increased demand for alternative methods, newer classes of assets have emerged, and the alternative investments market has extended into other areas such as art, collectables, wine, precious metals, gems, oil and gas drilling operations, natural resources such as wind and solar energy, cryptocurrencies and NFTs (Non-Fungible Tokens), to name a few.

As time goes by and the demand for diversification increases, financial markets with endless imagination and innovation continue to discover and present new classes of assets to investors.

These high risk-reward opportunities that in the past were limited to super high-net-worth individuals (HNWI) and institutional investors only, are today accessible to every category of investor through direct or indirect investments. In indirect investing, the investor uses the services of an intermediary, such as a fund manager, who pools multiple investors’ capital and invests on their behalf.

Other trends for private investors consists in going from public to private markets and to turn to passive versus active investing.

The primary objective of alternative investments was to diversify the investor’s portfolio. This means dividing the risks and rewards by investing in different asset classes. These can be correlated and noncorrelated asset classes in order to hedge or to protect the capital against unwanted market moves. However, its role has since developed.

MODERN PORTFOLIO THEORY

In the 1950s and 1960s, ‘modern portfolio theory’ established the mechanics and benefits of diversification. This framework highlighted risk as a function of a portfolio, formalizing the idea that exposure can be reduced by holding a wide range of investments.

But currently, after a decade-long period of low interest rates and Central Bank monetary interventions, traditional investments are forecasted to deliver modest returns of approximately 4% or less per year, over the next 10 years. Both institutional and individual investors are not only looking for diversification, but most prominently for return, known also in financial jargon as ‘yield’.

A Preqin survey in 2018 had found that 84% of investors were planning to increase the amount of capital they commit to alternative assets over the next five years.

While alternative investing represented just 5% of global pension portfolios in 1996, in 2019 these accounted for more than 25%. Depending on the risk appetite, current data indicate that between 10% and 20% of diversified investment portfolios contain alternative investments, including real estate.

Most individual investors devote only 5% to alternative investments. Pension funds and endowments however are well above that, with 30% and 50% respectively invested in alternatives to further diversify investor portfolios and gain exposure to the income and yields that these opportunities offer.

Another key driver for the spike in the demand for alternative investing has been the expansion of the emerging markets, both as investment targets and as new wealth generating areas, where capital is likely to be invested. The Asia-Pacific region, the Middle East and Latin America in particular, South east Asia, China, India, and Brazil are playing an increasingly important role both as a source of capital from investors allocation to alternatives, and as the focus of investment opportunities for fund managers looking to deploy capital.

It is no surprise that the alternative asset industry has grown exponentially in recent years, with the Assets Under Management (AUM) reaching record highs in recent years. The trend shows no sign of slowing or coming to a halt.

In 2021, fundraising for alternative assets, including private equity, real estate, infrastructure, private debt, and natural resources, surpassed $1.1 trillion. And total assets under management in alternatives exceeded $9 trillion, according to Moody’s. Global alternatives under management rose from $7.9 trillion in 2013 to over $10 trillion in 2020. The volume is expected to reach $14 trillion by 2023 and $21.1 trillion in 2025.

PRIVATE EQUITY

In the dominant asset classes, private equity is in the lead, followed by hedge funds. Private equity is in fact, the name of the asset class of funds, and the activities of investors investing directly in private companies or engaging in buy-outs of public companies, result in delisting of the public company.

In 2021, the asset class raised $737 billion and reached $5.8 trillion in assets under management after delivering an annual return of 45.2% through March 2021. Analysts at Moody’s predict that private equity will continue to deliver strong returns in2022.

Private equity, known for its high risk-reward correlation, is currently the most popular asset class in the alternative investment world. The U.S. Private Equity Index provided by Cambridge Associates shows that private equity produced average annual returns of 10.48% over the 20-year period ending on June 30, 2020, while during that same time frame, the Russell 2000 Index, a performance tracking metric for small companies, averaged 6.69% per year. The S&P 500 index returned 5.91%.

THE HURDLES ON THE WAY

For Moody’s, although the overall 2022 outlook for the asset management industry is stable for now, the booming alternative asset classes come with some risks. In their report, Moody’s highlights three potential hurdles investors may face in the alternatives, in the near future.

One of the hazards is Moody’s concern for the risk of rising systemic credit as a result of increased allocation to these leveraged assets; private equity funds typically conduct leveraged buyouts, and, as the asset class grows, so does the amount of borrowing. As there have been lots of borrowing, companies tend to carry a fair amount of debt, with aggressive debt structure. As this happens in private markets, there is less visibility inside the debts that the companies carry.

With the growth in activity and cheap credit available, many ‘lower-rated’ companies have been borrowing more capital. According to the report by Moody’s, the question is whether weaker credit can withstand high rates or a downturn. With lower rates, weaker creditors have been tempted to buy more, but if the rates rise, it is possible that they may not be able to support the debt.

Another important risk is that of liquidity. By definition, alternative assets are much less liquid than traditional assets. The illiquidity that comes with investments in alternative asset classes can put future stress on investment portfolios, and with regard to private investments, investors are unable to exit their investments as easily as they can sell public stocks and bonds.

Lastly, a general risk that applies to every investment vehicle in the alternative investment world is that of regulation. As many alternative investing, including private equity happens in the private market with less surveillance, the investor should be prepared to embrace the hazards that go with it.

Our era is not only defined by the 2008 recession, low interest rates, monetary interventions of central banks, and the longest bull market in history, but also by an unprecedented Covid-19 pandemic, lockdowns, quarantines, event cancellations, and a worldwide switch to remote work, that have reset the trends in the future of investing.

DEEP TECH & VENTURE CAPITAL

According to McKinsey, the most negatively impacted sectors by Covid-19 include real estate, travel and hospitality, logistics, media, retail and consumer durables. On the other hand, fintech, software, telecom, healthcare, pharma & biotech and tech services have boomed, while sectors such as asset management and business services have remained neutral in the face of the pandemic.

Covid-19 obliged us to sit at home and turn to the digital world. Now, this trend has taken over and the importance of deep tech in our epoch has turned Venture Capital into another thriving asset class, providing historically significant alpha in sophisticated institutional investor portfolios. Top absolute returns for venture capital have historically exceeded and outperformed those for other asset classes such as real estate. While the return on investment for real estate is 27% in 5 years and 24% in 25 years, the returns on Venture Capital are 48% and 57% respectively. (Source: Cambridge Associates Global Venture Capital, Global Private Equity, and Global Real Estate Benchmarks Return Report).

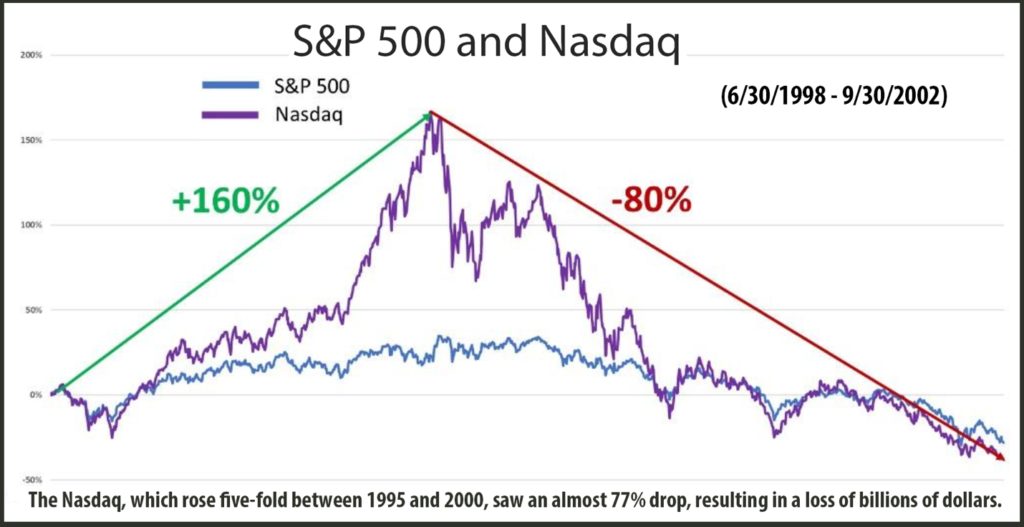

Venture capital (VC) is another form of private equity – inherently risky and illiquid – involving investment in startup companies which are traditionally high growth and often technology-centric. A venture-backed company will typically raise multiple rounds of financing before reaching an exit, which is often either in the form of a sale to a larger incumbent or through an initial public offering (IPO). While investors known as LPs (Limited Partners) left the Venture Capital industry after the Nasdaq bubble in 2000, they have now been returning to the asset class, together with other non-traditional investors such as mutual funds, hedge funds and sovereign funds.

In the last decade, the world has witnessed an explosion in technology-based innovation, producing hundreds of billion-dollar companies, so-called ‘unicorns,’ and boosting interest in private technology investment. In our era the difference between a young company and an established company is thinning. Uber was founded in 2009 and is currently valued at $68 billion. Airbnb was started in 2008 and last raised funding at a $25.5 billion valuation. The universality of smartphones and the transformation in cloud computing and storage has created a rich territory for starting and building companies at historically low costs with sky rocketing potentials, and entrepreneurs and investors have capitalized on these trends. Software is eating the world and the phenomenon of technology disrupting all industries is a continuing trend.

Deep tech – the generic term for technologies that include artificial intelligence, robotics, blockchain, advanced material science, photonics and electronics, biotech and quantum computing – is where the capital will go in the coming years. One concrete example is the development of 3D printers. The cost of 3D printing a two-bedroom home is around $4,000, which is quite inexpensive in comparison to the cost of that same home using manual labour. In geographic areas that need a lot of housing for a low cost, this technology will of course be a game-changer for both real estate and space investing. As an example, this can – and is predicted to – impact the real estate investment space which is a major subset of alternative investments.

As the pandemic continues with quarantines, lock-downs and event cancellations and much uncertainty regarding the future, many investors may have decided to stick with the most secure investments rather than gambling in unknown territory. At the same time, many have embraced alternative investing with even more pace than before, regardless of the environment looking safe or not.

CRYPTO ASSETS

For years, many on Wall Street thought of cryptocurrencies as a fringe asset class. Yet, a recent survey from Fidelity found that more than half of institutional investors in Asia, Europe and the U.S. currently invest in digital assets, and a majority also expect to do so in the future. This means that Bitcoin has matured from an obscure asset class with few users to an integral part of the digital asset revolution.

There are now talks of turbo certificates and ETFs on Bitcoin, issued by established banks and financial institutions in traditional assets.

The market value of these novel assets rose to nearly $3 trillion in November 2021, from $620 billion in 2017. Despite high volatility their popularity has soared among retail and institutional investors alike. Since the beginning of 2022, the combined market capitalization had retreated to about $2 trillion, still representing an almost four-fold increase since 2017.

Bitcoin, Ether, and other crypto assets showed little correlation with major stock indexes before the pandemic. But as the central banks across the world started to unleash unprecedented levels of financial support in the face of the health crisis, crypto prices and US stocks both soared on heightened risk appetite among investors.

Today, Bitcoin is becoming increasingly correlated with the stocks. So, with the increased and sizable co-movement and spillovers between crypto and equity markets, the digital currency contains limited risk diversification benefits, as opposed to its initial role.

Given their relatively high volatility and valuations, their increased co-movement could soon pose risks to financial stability, especially in countries with widespread crypto adoption. Very soon, the world can expect a significant regulatory movement in the crypto market.

In the US, a $1.2 trillion bipartisan infrastructure bill signed by president Joe Biden in November 2021 includes crypto tax reporting provisions that could make it easier for the IRS to track crypto activity among Americans. The new regulations will most probably disrupt the price movements of the already volatile cryptocurrencies.

BETTING ON DIGITAL UNIQUENES

In recent months, technology has been at the forefront of discussions around alternative assets, with the emergence of a new, highly sought-after form: the non-fungible token (NFT). The total market cap of NFTs is about $31.4 billion, making up 1.53% of the current $2.05 trillion total market cap for cryptocurrency.

NFTs have been around since 2014, but came to light and gained momentum in 2020, coinciding with the start of the pandemic.

NFTs represent the uniqueness of a digital asset, conveying ownership of a digital file (a piece of music, a work of art, GIF, JPEG, essay, domain name, game, or purchases within games, etc.) that is non-fungible, meaning highly unique pieces of digital art that only one person can own.

This data is stored on a blockchain such as Ethereum, with the knowledge and reassurance, via the blockchain, that the NFT is the only ‘authentic’ one of its kind. As they cannot be altered or counterfeited, NFTs are intended to be a secure method of asset ownership, more easily transferable than traditional assets.

Ever since Mark Zuckerberg announced the rebranding of Facebook to ‘Meta’, the notion of the metaverse has gone mainstream worldwide. Those in favor of NFTs speculate that in the future, when the metaverse – a digital world where people play, work, advertise, socialize, and transact – becomes the norm, NFTs will be the essentials to own for our avatars to exist and function. Investment in digital real estate is now also possible via NFTs.

By the end of 2021 the NFT market valuation reached $41 billion, coming close to that of the traditional art market at $50 billion in 2020. As a side note, the art market was down substantially in 2020, due to the pandemic and canceled fairs.

On the downside, one can mention the following counter arguments : at the moment, NFT worth is entirely tied to aesthetic, sentimental value and speculation. Right now, it is impossible to gauge its worth as a long-term investment. NFTs have been the target of a few security breaches, scammers, hackers and stolen wallets. Furthermore and most importantly, creating and selling NFTs accounts for a lot of power usage, as do blockchain transactions, hence unsustainable and damaging for the planet in the long run.

STATE OF THE MARKET

While the entire world suffered in 2020, the contemporary art market rose by 15.1%, showing that the asset class is the least correlated of all asset classes. The ultra-wealthy continued buying art during the pandemic, with more appetite than before, and as shows and art fairs were canceled with fewer opportunities to buy paintings, the value of art continued to improve.

The longer-term outlook for the market is bright, with increased interest from young collectors. And with middle-class households entering the market, a new class of buyers is being created. Also, with more sophisticated infrastructure for online sales emerging, art is becoming more accessible to everyone. For instance, Singulart, the online gallery that was founded in 2017 in Paris has raised EUR 60 million in series B round, one of the stages in the capital-raising process of a startup. From this fact alone, one can deduct that the marriage between tech and art is here to stay.