© Edm

Since Karl Benz designed the first functional automobile in 1885, we have seen remarkable progress in the world of cars. They have become smarter, faster and more affordable and are no longer the preserve of the elite. However, the proliferation of cars has also raised the pressing issue of pollution. The transport sector, including cars, is one of the main contributors to greenhouse gas emissions in the European Union.

Reducing emissions from vehicles is therefore seen as crucial to achieving the EU’s ambitious climate neutrality targets. In recent decades, alternatives have been sought to fossil fuels, which are not only harmful to the environment, but will also eventually be exhausted and run out. Humanity needs alternative and renewable options.

Although the first electric car was invented more than a century ago, Elon Musk and his company Tesla Motors have played a crucial role in the spread of electric vehicles and driven the global transition to sustainable transport.

Tesla revolutionised the electric car industry by introducing the first modern and commercially successful electric vehicle. The company pioneered the use of lithium-ion batteries and gained international recognition. The Tesla Roadster, launched in 2008, was an important milestone as it was Tesla’s first mass-produced car and paved the way for the company’s rapid growth. Until very recently, Tesla was the world’s largest manufacturer of electric vehicles with a market valuation of over US$ 660 billion. However, in 2023, a conglomerate of Chinese manufacturing companies led by BYD officially overtook Tesla in terms of sales figures. BYD has seen significant growth, almost doubling its sales last year. China has a robust domestic electric vehicle industry with various manufacturers such as NIO, BYD, XPeng Motors and others. These companies produce a wide range of electric cars, including cheaper models compared to their competitors.

The Chinese government has actively supported the introduction of electric vehicles to reduce air pollution in major cities and reduce dependence on traditional fossil fuels. Chinese manufacturers have the advantage of lower labour costs, government incentives, subsidies and supportive policies, as well as seamless integration into the local market. In response to these favourable conditions, several international car manufacturers, including Tesla, have set up production facilities in China to benefit from the same local production advantages.

Tesla quickly gained international popularity due to a unique combination of factors. Its electric cars were characterised by a modern and futuristic design, coupled with the integration of innovative technologies, smart business strategies and a growing market demand for sustainable transport. Tesla’s first models, such as the Model S and Model X, wowed consumers with their impressive performance, long electric range and cutting-edge technology.

In response to the growing demand from European consumers for environmentally-friendly alternatives to conventional cars, Tesla emerged as a satisfactory solution. Recognising the need, the company invested in building an extensive and convenient charging network across Europe and the US, addressing a common concern of potential electric vehicle buyers. The charismatic leader of Tesla, Elon Musk, gained a lot of media attention for his actions and statements, which were often controversial and widely discussed. This helped to consolidate Tesla’s enthusiastic fan base in Europe and worldwide.

The high demand for Tesla cars led to long waiting lists. Over time, however, Tesla’s electric vehicles proved their value to consumers, receiving favourable reviews and awards for their innovation, safety and performance. With the increasing popularity of electric vehicles, Tesla expanded its product range to include more affordable models such as the Model 3, which is very popular with Europeans.

Tesla challenged the traditional car manufacturers and captured the attention of European consumers. Tesla’s resounding success served as a catalyst for other car manufacturers to enter the emerging electric vehicle market and compete for a share. Over time, more and more car brands recognised the potential of electric vehicles and included them in their product portfolio to appeal to specific customer segments. As of 2022, the Volkswagen Group emerged as the leading car manufacturer in Europe, having sold over 349,100 new electric vehicles. (source: Statista.com).

However, Tesla continues to assert its dominant position in the European electric car market. The latest data shows that Tesla’s Model Y SUV has sold more than 71,000 units, putting it in the top spot. The Model 3 follows closely behind with almost 20,000 units sold. In third place is the Volkswagen ID.3, which recorded an impressive increase of 105% compared to the previous year, while the ID.4, another Volkswagen model, and the Dacia Spring occupy fourth place with over 14,000 units sold and an increase of 56%. The Dacia Spring, known for its affordability, has gained popularity among urban electric car buyers.

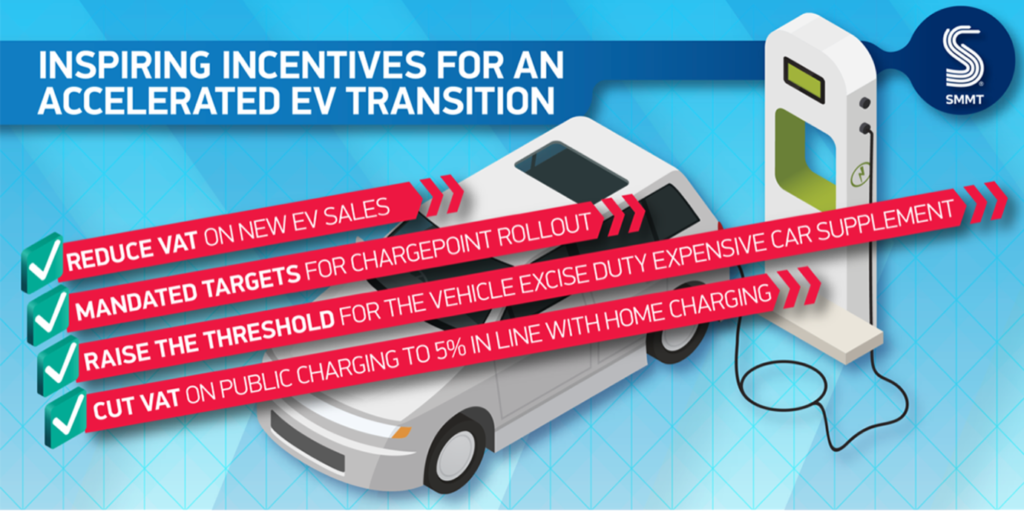

In recent years, the market for electric cars in Europe has experienced remarkable growth and development. Various factors have played a crucial role in the strong consumer demand for electric vehicles in the region. One important factor is the proactive engagement of governments in European countries where governments have introduced incentives such as tax rebates, subsidies and free parking to make electric vehicles financially attractive to consumers despite their initially high prices. In Finland, for example, electric vehicles are exempt from registration tax until 2025, and road tax and charging infrastructure for electric vehicles were subsidised by up to 35% until December 2022.

Denmark has introduced electricity tax reductions specifically aimed at promoting the use of commercial electric vehicles. In addition, it has reduced registration fees for electric vehicles by 60% to further incentivise their purchase and use. In Sweden, the government grants subsidies that cover up to 50% of the purchase and installation costs for charging stations.

In an effort to make the installation of charging stations more financially viable while increasing supply and reducing charging costs, the Dutch government has introduced an energy tax rebate for charging stations until 2024. Iceland, the country with the second highest number of registered electric vehicles in 2023, sources all of its electricity from fully renewable sources. This has enabled Iceland to provide low-cost electricity, a key factor that has favoured faster adoption of electric vehicles by citizens.

Norway tops the list of countries with the highest proportion of electric vehicles in their vehicle fleet in 2023 with 91.3 %. This is largely due to the fact that Norway introduced a comprehensive package of coordinated, consistent support measures for electric vehicles starting in the 1990s – over a decade earlier than other countries. The country continues to incentivise EV drivers by halving tolls on roads and car parks. Almost all European Union member states now offer some form of fiscal incentive to expand their electric vehicle markets, albeit with their own individual policies and strategies. Only six EU countries – Bulgaria, Denmark, Estonia, Malta, Latvia and Slovakia – have not directly subsidised the purchase of electric vehicles, although many of them still provide tax breaks or exemptions for the purchase of new EVs to stimulate their markets.

Several countries are incentivising companies to electrify their vehicle fleets through tax breaks, subsidies or discounted charging facilities. Owners of electric vehicle are often entitled to free or reduced motorway tolls, parking spaces or bridge tolls. In some areas, EVs are given access to the lanes for high-occupancy vehicles (HOVs), which shortens journey times. Many EU countries have passed laws requiring the inclusion of charging infrastructure in the planning of new buildings. The expansion of charging facilities is crucial for the widespread acceptance of electric vehicles. Significant investment is being made across Europe to expand the network of charging stations, including fast charging facilities, to improve the usability of EVs for daily use.

However, there are signs that these concessions are gradually disappearing or diminishing as governments across Europe consider EVs to be sufficiently mainstream and uptake increases, meaning that fewer tax concessions are required. However, this approach risks unintended consequences. Many people have a strong attachment to their vehicle and are reluctant to give up tradition for the sake of modernity or environmental protection.

Many EU Member States have introduced scrappage schemes to incentivise the exchange of older, polluting vehicles for new electric vehicles. From 1992, a number of Euro standards were introduced in the EU to limit emissions from conventional cars, thereby reducing pollution and encouraging car manufacturers to produce more environmentally friendly vehicles. The standards have gradually evolved and now drastically restrict the access of many highly polluting vehicles in the centres of major European cities, which is another reason to consider buying an electric car.

From the initial EURO 1, we have now reached the EURO 7 standard for new cars. “The Euro 7 standards rules will be the first worldwide emission standards to move beyond regulating exhaust pipe emissions and set additional limits for particulate emissions from brakes and rules on micro plastic emissions from tyres, to apply to all vehicles, including electric ones. The new rules will regulate the durability of batteries installed in cars and vans in order to increase consumer confidence in electric vehicles. This will also reduce the need for replacing batteries early in the life of a vehicle, thus reducing the need for new critical raw materials required to produce batteries.” (source: ec. Europa.eu)

Environmental protection is gaining in importance for many Europeans. As a result, consumer preferences are changing towards more sustainable and environmentally friendly modes of transport, including electric vehicles. The cost of fossil fuels in Europe has traditionally been relatively high and subject to major fluctuations, especially in recent years. Combined with the lower running costs of electric cars, this factor increases their attractiveness.

Car manufacturers across Europe and around the world have recently introduced a variety of electric vehicle models to meet every consumer need. Battery-powered cars were the third-most popular choice for buyers last year, ahead of diesel vehicles. According to the European Automobile Manufacturers’ Association (www.acea.auto) the market share of fully electric cars in the European Union was 14.6% in 2023. Large car markets in Europe such as Germany, France and Spain recorded particularly high electric car shares. Only four EU countries – Cyprus, Poland, the Czech Republic and Slovakia – recorded a share of electric vehicles of less than 5% of their total fleet. (source: eea.europa.eu).

Nevertheless, EV sales fell in December 2023 compared to the previous December 2022, especially in Europe’s largest car market, Germany. While recession risks are looming across Europe due to financial and economic instability, EV sales could reflect this volatility. Overall, however, the number of e-cars has increased significantly. The German Volkswagen Group has established itself as one of the most popular brands for electric vehicles in Europe. This result was in some ways to be expected, as Germany leads the way in Europe with almost 1.5 million registered electric vehicles. Surprisingly, the Skoda Enyaq was the best-selling electric car manufacturer in Germany last year.

Electric vehicles are also gaining ground in freight and passenger transport. In the last ten years, app-based shuttle and ride-sharing services have emerged that utilise electric cars, such as Uber Green and Green Mobility. In addition, major delivery companies such as FedEx and Amazon have converted large parts of their delivery fleets to electric cars. These changes in the economy have contributed to an increasing demand for electric commercial vehicles.

Bloomberg has forecast that the market for electric vehicles will reach 8.09 trillion euros by 2030. In the European Union, almost half of all new passenger car registrations between January and November 2023 were electric cars. In general, young professionals, educated millennials and Generation Z are the main target group for electric vehicle manufacturers, as 18 to 44-year-olds are much more inclined to buy electric vehicles. In 2024, sales in the European electric car market are estimated at around €168 billion and are expected to increase by 12.11% year-on-year from 2024 to 2028. However, while electric car sales continue to rise, car dealers have observed a slowdown in growth in recent months. This slump is due to economic conditions in many EU countries as well as the discontinuation of various purchase incentives previously offered by European governments for buyers and owners of electric vehicles.

However, the once-novel electric vehicles are quickly becoming a ubiquitous sight on the roads. The acceptance of electric cars as a means of transport is increasing, especially on the European continent but also in countries such as Japan and Korea. China has also become a major player when it comes to electric vehicles. In 2023, 25% of all cars sold in China were electric-powered, generating sales that exceeded total global sales in the rest of the world.

In a departure from the early, purely commuter-oriented commercial electric vehicles, electric vehicles now offer sufficient range for longer journeys. However, the high manufacturing costs, especially for batteries, which drive up the purchase price, remain a key challenge for electric vehicle manufacturers. To overtake conventional cars, vehicle manufacturers need to find more efficient and cost-effective production alternatives while developing batteries with faster charging capabilities – another factor that makes consumers hesitant when considering buying an electric car. Billions of euros have been earmarked for investment to achieve these goals by 2030. At the same time, replacements are being sought for certain rare minerals currently found in standard car batteries, some of which are of strategic importance or are becoming geopolitical bargaining chips.

With the increase in sales of new electric vehicles, the supply of used electric cars is also growing. However, the used car market for electric cars is still less attractive than that for conventional used vehicles. According to an analysis by iSeeCars.com, electric vehicles depreciate faster than any other type of vehicle, losing on average around 49% of their value after just five years. This is mainly due to rapid technological advances that make electric vehicles obsolete, as well as adjustments to account for the diminishing value of tax incentives over time.

In electric vehicles, the battery is an important and cost-intensive component. Therefore, many consumers are reluctant to buy a used electric vehicle if they have no certainty about the quality and remaining life of the battery. Although EV batteries are typically designed to last 10 to 20 years, certain factors can shorten this period. For example, batteries can degrade more quickly in hotter climates where air conditioning systems are exposed to additional stresses. To reassure used car buyers, many manufacturers now offer extended warranties for batteries. In some European countries, it is also possible to transfer government incentives to buyers of used electric vehicles. However, the total cost of a used electric car is still significantly higher than that of comparable gasoline-powered vehicle, with a used electric car costing around €36,000 on average at the end of 2023.

Furthermore, the supply of used EVs is limited overall due to the nascent nature of the electric vehicle sector. For example, of the 1.4 million used cars offered for sale on mobile.de, Germany’s largest online car marketplace, around 5.5% are used electric vehicles, a significantly below-average market share compared to gasoline-powered cars.

Even with the obvious environmental benefits of electric vehicles, some remain skeptical; they believe that the destruction of batteries reflects the manufacturing requirements, which are very resource-intensive. Proponents of alternatives such as fuel cell cars argue that technologies such as hydrogen could soon rival and possibly even surpass battery electric vehicles.

Despite lingering doubts, forecasts for electric vehicles in Europe remain encouraging as the continent continues to push ahead with its ambitious vision of a sustainable transport system. The tightening of emissions standards across the EU, coupled with continued innovation, promises to dramatically reshape the sector through this definitive, industry-wide transition.

The widespread adoption of electric vehicles promises significant environmental benefits and economic stimulus through job creation. As more and more European cities commit to carbon neutrality and enact increasingly stringent emissions policies, electric cars seem ideally suited to provide cleaner, greener transport and position the continent as the global vanguard of the EV revolution.