© Edm

The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, has published the second Trends, Risks and Vulnerabilities (TRV) Report of 2022 * The Russian war on Ukraine against a backdrop of already-increasing inflation has profoundly impacted the risk environment of EU financial markets, with overall risks to ESMA’s remit remaining at its highest level.

In the first half of 2022 financial markets saw faltering recoveries, increasing volatility and likelihood of market corrections. Separately, crypto-markets saw large falls in value and the collapse of an algorithmic stablecoin, highlighting again the very high-risk nature of the sector.

Verena Ross, Verena Ross, Chair of the European Securities and Markets Authority (ESMA), said: “The current high inflation environment is having impacts across the financial markets.

Consumers are faced with fast rising cost of living and negative real returns on many of their investments. Consumers also need to watch out as they might be targeted by aggressive marketing promoting high-risk products that may not be suitable for them.

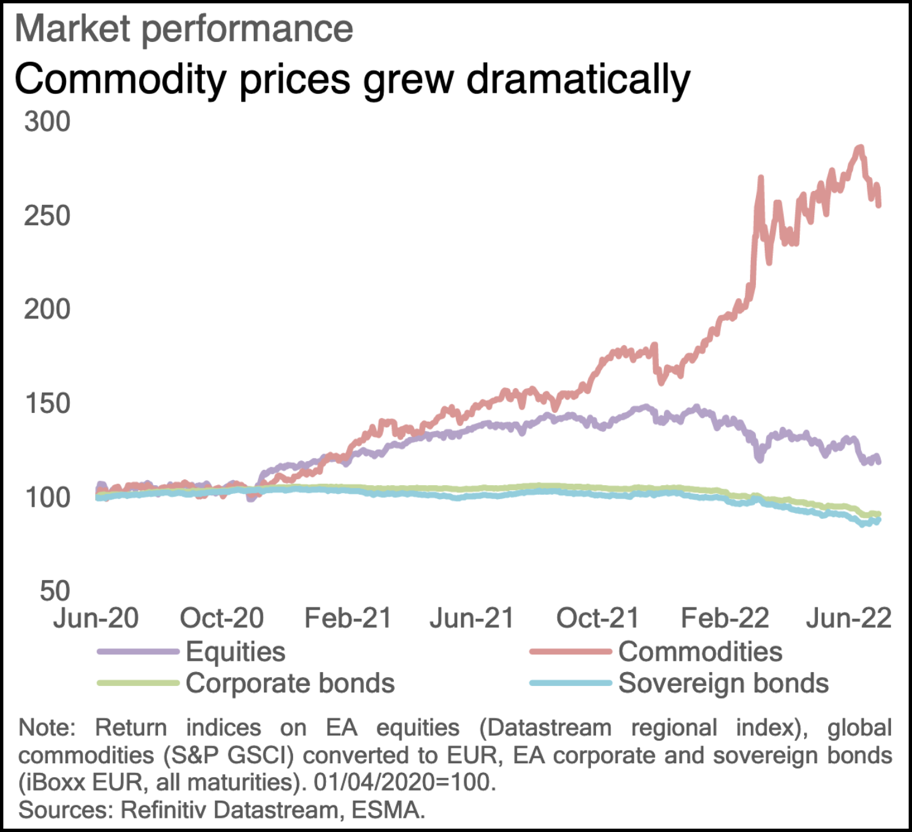

The Russian invasion of Ukraine continues to significantly affect commodity markets, leading to rapid price increases and elevated volatility. These present liquidity risks for exposed counterparties and show the continued importance of close monitoring to ensure orderly markets, a core objective for ESMA.”

RISK SUMMARY AND OUTLOOK

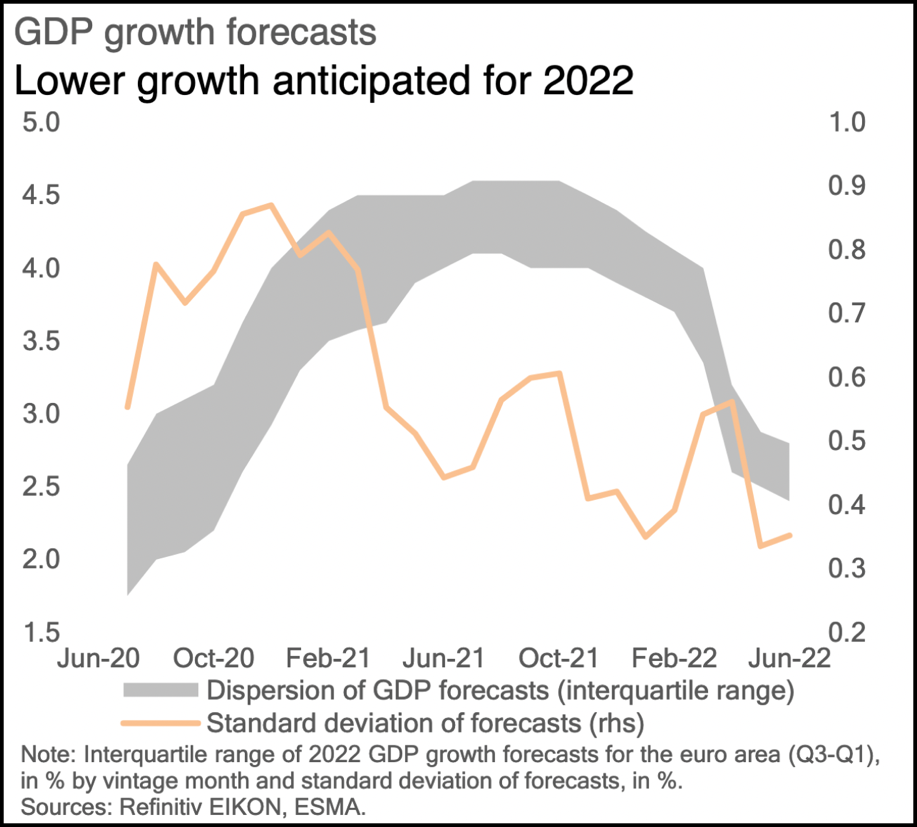

The overall risk to ESMA’s remit remains at its highest level. Contagion and operational risks are now considered very high, like liquidity and market risks. Credit risk stays high but is expected to rise. Risks remain very high in securities markets and for asset management. Risks to infrastructures and to consumers both remain high, though now with a worsening outlook, while environmental risks remain elevated. Looking ahead, the confluence of risk sources continues to provide a highly fragile market environment, and investors should be prepared for further market corrections.

MAIN FINDINGS

Market environment: The Russian aggression drove a commodities-supply shock which added to pre-existing pandemic-related inflation pressures. Monetary policy tightening also gathered pace globally, with markets adjusting to the end of the low interest rates period.

Securities markets: Market volatility, bond yields and spreads jumped as inflation drove expectations of higher rates, equity price falls halted the recovery that had started in 2020, and invasion-sensitive commodity values surged, particularly energy, impacting natural gas derivatives and highlighting liquidity risks for exposed counterparties.

Asset management: Direct impacts of the invasion were limited but the deteriorating macroeconomic conditions amplified vulnerabilities and interest rate risk has grown with expectations of higher inflation. Exiting the low-rate environment presents a medium-term challenge for the sector.

Consumers: Sentiment worsened in response to growing uncertainty and geopolitical risks. The growing volatility and inflation could negatively impact many consumers, with effects potentially exacerbated by behavioural biases. Household savings fell from the record highs of the pandemic lockdowns.

Sustainable finance: The invasion presented a new major challenge to EU climate objectives as several member states turned to coal to compensate for lower Russian fossil fuel imports. Although EU ESG bond issuance fell and EU ESG equity funds experiencing net outflows for the first time in two years, funds with an ESG impact objective were largely spared and the pricing of long-term green bonds proved resilient.

Financial innovation: Crypto-asset markets fell over 60% in value in 1H22 from an all-time-high, amid rising inflation and a deteriorating outlook. The sharp sell-off, the Terra stablecoin collapse in May, and the pause in consumer withdrawals by crypto lender Celsius, added to investor mistrust and confirmed the speculative nature of many business models in this sector.

*https://www.esma.europa.eu/sites/default/files/library/esma50-165-2229_trv_2-22.pdf