AI generated image

“Money is a terrible master but an excellent servant”. (Phineas Taylor Barnum)

Money wasn’t born overnight. It evolved from trust, necessity, and shared belief in value. Long before coins and paper banknotes, people exchanged goods, but as societies grew, it became too complicated. What if you didn’t need what the other person offered? To solve this, early civilisations began using objects with agreed upon, such as shells, salt, or pieces of metal as a medium of exchange. These items were practical, portable, and recognised and approved within the community.

The first real money, as we understand it today, appeared around 3,000 BC in Mesopotamia, where silver bars were weighed to match the value of goods. This system introduced the idea of a standard unit of value. Later on, around 600 BC, the first minted coins were made of electrum, a natural mixture of gold and silver, stamped with official symbols to guarantee authenticity and value. This invention changed everything. Coins were easier to carry, more durable, and trusted. They helped empires grow, trade expand, and economies flourish.

While coins ruled the world for centuries, the idea of paper money came much later in China, during the Tang Dynasty in the 7th century, and became more widely used under the Song Dynasty, around the 11th century. As coins were heavy and hard to carry in large amounts, merchants needed a lighter, safer, and more practical way to handle money. Chinese traders began depositing their coins with trusted shops and received paper receipts in return, which could be exchanged back for metal money when needed.

Banknotes didn’t appear in Europe until much later, around the 17th century—first in Sweden, before spreading throughout the continent. They became popular for the same reasons: convenience and security. Over time, banks and governments guaranteed their value, building public trust. Every printed banknote was backed by a certain amount of gold stored in the national bank, and in theory, you could exchange paper money for physical gold.

Today, however, most countries no longer use the gold standard. The value of money comes from trust in the government and the strength of economies themselves, not from actual gold reserves. Printed money is no longer limited by the amount of gold central banks hold, though they still retain gold as part of their reserves.

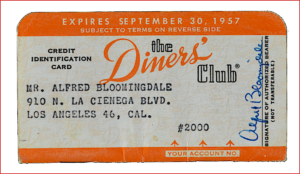

In the 1950s, another idea emerged: the bank card – a plastic tool to access your money without using cash. It all began in the United States with the launch of the Diners Club Card. It wasn’t a bank card in today’s sense but rather a charge card, meant for paying at restaurants. It quickly became popular among business travellers and was accepted at an increasing number of locations.

The first true credit card issued by a bank came shortly after. In 1958, Bank of America introduced the BankAmericard in California, which allowed users to buy now and pay later, with the option to carry a balance over time. It was the forerunner of what we now know as Visa.

Curiously enough, debit cards were only developed later, in the 1970s, as banks began to introduce ATMs. By the 1980s and 1990s, debit and credit cards had become widespread, thanks to improved technology, security features, and international networks like Visa and Mastercard. Suddenly, the old saying that ‘cash is king’ started to fade… Bank cards completely transformed how we pay today. Many argue that it is not the same and even harms the way we see and value our money. ‘When you pay with cash, you feel the loss. With a card, it’s painless… and that’s the danger.’ (Dave Ramsey, financial adviser)

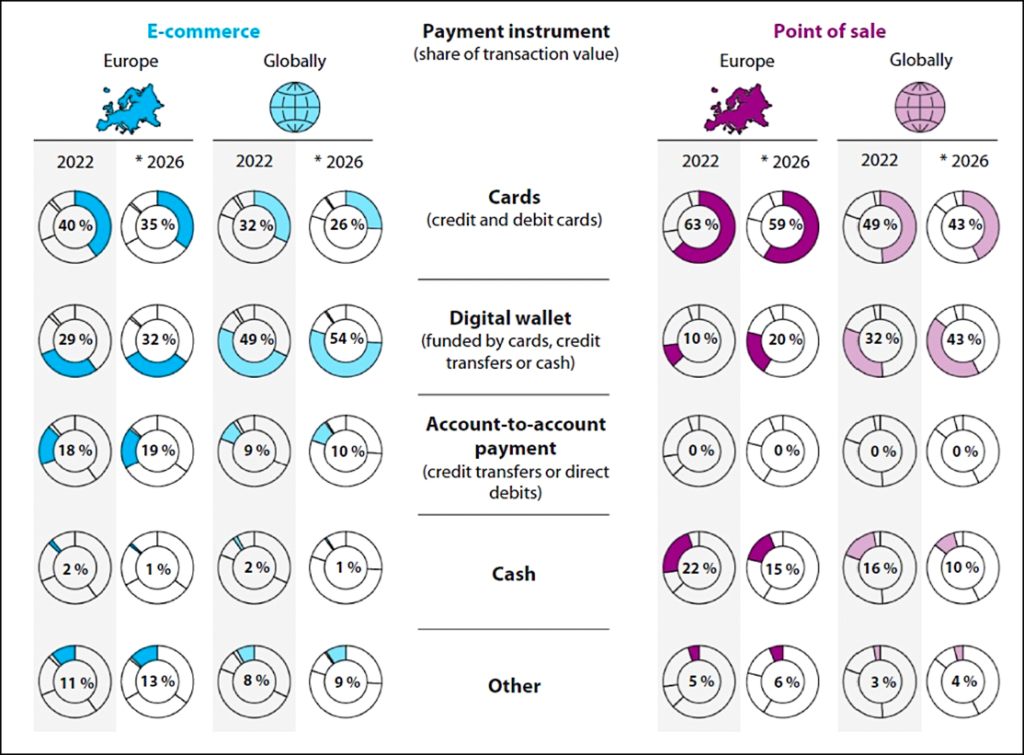

Globally, non-cash transactions reached approximately US$1.3 trillion in 2024, “with projections showing a 15% annual increase, reaching US$2.3 trillion by 2027” (Source: Zimpler.com). The shift from cash to card payments has accelerated rapidly across Europe, particularly following the COVID-19 pandemic, which drove widespread adoption of contactless transactions. However, the pace of this transition varies considerably between countries.

Nordic nations lead the cashless revolution. In Norway, around 98% of consumers use debit or credit cards, with cash accounting for just 3% of point-of-sale (POS) transactions. Sweden has seen cash usage decline to roughly 10% of all POS transactions (The Guardian). Similarly, Finland and the Netherlands report high card usage rates of approximately 70% (Source: European Central Bank).

Ireland demonstrates particularly strong adoption of digital payments, where 87.1% of all card transactions are contactless. Notably, mobile wallets like Apple Pay and Google Pay represent over half of these contactless payments (Source: The Times).

Despite the surge in digital payments, several European nations – including Malta, Austria and Slovenia – continue to rely heavily on cash. Even Germany, despite its reputation for technological innovation, conducts approximately 71% of transactions in cash. For instance, not so long ago, in Berlin, many shops displayed ‘Cash Only’ signs or imposed a €20 minimum for card payments.

Switzerland similarly maintains a strong cash culture, with 92% of retail outlets accepting physical currency – a notable figure given the growing popularity of mobile payment apps (Source: Swiss National Bank).

Across the Eurozone, card payments now account for 39% of transactions, while mobile payments have doubled to 6% in recent years (Source: Reuters).

On 4 June 2025, Payments Europe hosted a conference in Brussels, bringing together experts and stakeholders to examine the latest developments in the payments landscape. The event unveiled groundbreaking research drawing on insights from over 13,000 consumers and more than 3,750 businesses across 15 European countries.

Key findings revealed that 72% of merchants now favour digital payments over cash, 87% of consumers feel current payment options meet their needs adequately, and 91% of businesses view digital payments as essential. Also, 61% of consumers believe digital payment acceptance should be mandatory.

These statistics demonstrate a decisive shift towards digitalisation, highlighting rising expectations for seamless, secure, and inclusive payment systems across Europe. (Download the full report here https://www.paymentseurope.eu/truevalue-european-report-2025/.

While digital payments offer undeniable convenience, they also introduce significant security risks and systemic vulnerabilities. The European Central Bank (ECB) has highlighted weaknesses in current digital payment systems, stressing the urgent need for EU-controlled payment infrastructure to mitigate these threats. Meanwhile, countries like Sweden and Norway actively advise citizens to maintain cash reserves for emergencies, recognising the potential for widespread digital disruptions.

Recent power outages have laid bare the inherent vulnerabilities of digital payment systems, with both card transactions and online payment platforms experiencing severe operational disruptions during blackouts. While this digital transformation has streamlined Europe’s financial infrastructure, it has done so by sacrificing systemic resilience – creating critical exposure to unexpected infrastructure failures.

Several incidents have revealed the fragility of digital payment infrastructure. In November 2024, Italy suffered significant disruptions to electronic payments after strategic fibre-optic cables in Switzerland were damaged during gas pipeline installation works.The incident impacted Worldline, a leading European payment processor, causing widespread ATM failures and POS system outages across Italy.

In March 2025, the European Central Bank’s TARGET2 system – the €3 trillion daily lifeline of Eurozone transactions – suffered a seven-hour complete outage caused by a critical hardware failure. The disruption froze interbank payments across 19 member states, delayed securities settlements worth €420 billion, and blocked financial transfers for thousands of businesses across the Eurozone. This unprecedented failure in Europe’s core payment infrastructure has sparked urgent debates about system redundancy and financial contingency planning. (Source: Reddit).

On 28 April 2025, a massive blackout affected tens of millions across Spain and Portugal, disrupting daily life, halting transport and causing traffic chaos. Internet and mobile communications were also disrupted, leading to widespread failure of ATMs and electronic payments. Most businesses were unable to process card transactions, forcing a temporary return to cash-based payments. Many people were caught unprepared for such a scenario.

The widespread blackout resulted in significant economic losses, estimated for Spain alone at approximately €1.6 billion, with broader assessments placing the total economic impact at up to €4.5 billion (Source: Iberian Energy Regulatory Report, May 2025).

In May 2025, Estonia faced a brief but impactful card payment outage. The hour-long incident affected roughly 50% of the nation’s retail outlets. While authorities continue investigating the precise cause, officials stressed the critical need for alternative payment options – including cash – during such disruptions.

On 24 May 2025, Cannes suffered a significant power cut that affected the final day of the prestigious Cannes Film Festival. The blackout, reportedly caused by an arson attack on an electrical substation in Tanneron and sabotage of high-voltage lines in Villeneuve-Loubet, lasted around five hours. Approximately 160,000 households in the Alpes-Maritimes region – including Cannes and Nice – were impacted. The outage resulted in failed traffic light systems, closed shops and restaurants, and suspended train services. This incident underscored both the vulnerabilities of digital-only payment systems and the crucial need to maintain cash-based alternatives.

Recognising the growing risks associated with over-reliance on digital payments, several Nordic countries – including Finland, Sweden, Norway, Denmark and Estonia – are actively developing offline-capable card payment systems. These innovative solutions enable payment terminals to store encrypted transaction data during internet outages, automatically processing transactions once connectivity is restored. (Source: Reuters)

Many years ago, Mark Twain observed that “the lack of money is the root of all evil.” In times of chaos and major disruption, we can certainly see the truth in this. Therefore, to prevent such situations, we must be better prepared. Recent events have demonstrated that maintaining a balanced approach to payment systems – embracing digital advancements while ensuring adequate safeguards and alternatives are in place to handle unforeseen disruptions – is absolutely crucial.

These recent blackouts and incidents should serve as a stark reminder of the critical need for resilient infrastructure and robust contingency plans to mitigate their impact on essential services and daily life. Simultaneously, such events have reignited crucial debates about the vulnerability of Europe’s energy infrastructure, particularly regarding renewable energy integration. Energy experts now overwhelmingly emphasise the urgent requirement for substantial investments to strengthen grid stability and prevent future system failures.

The European Commission estimates that annual investments of approximately €70 billion will be required over the next 25 years to modernise local electricity grids and support the green transition. Through the Recovery and Resilience Facility (RRF), the EU plans to assist member states in upgrading and securing power grids, while simultaneously developing cross-border energy connections to ensure system stability. These efforts will include implementing smart grid technologies to improve demand management capabilities, creating a more resilient and efficient energy infrastructure across Europe.

In response to recent large-scale power outages that disrupted digital payments across Europe, the EU has implemented comprehensive measures to bolster financial system resilience. The Digital Operational Resilience Act (DORA), effective since January 2025, requires all financial institutions to conduct regular vulnerability assessments of their systems, ensure compliance with stringent security standards, and develop robust contingency plans to maintain operations during potential ICT disruptions. These provisions aim to safeguard Europe’s financial infrastructure against both cyber threats and physical system failures.

The Digital Euro represents a collaborative initiative between the European Central Bank (ECB) and the European Commission to create a digital complement to physical cash. This central bank digital currency aims to provide a secure, universally accessible, and efficient payment solution across the eurozone. Designed with three core objectives, the project seeks to accelerate the EU’s digital transformation, enhance financial inclusion, and reinforce the euro’s global standing. Its architecture incorporates critical features such as offline functionality, robust privacy safeguards, and cost-free basic services for citizens.

Currently in its preparatory phase, the initiative reached a significant milestone in June 2023 when the European Commission proposed legislation to establish its legal foundation. While the European Parliament and Council continue negotiations, the ECB anticipates finalising the political framework by early 2026, potentially enabling launch within two to three years thereafter (Source: Finance Europa).

Recognising the inherent vulnerabilities of digital-only payment systems, the EU actively advocates preserving cash as a critical backup during technological disruptions. This strategy promotes three essential safeguards: businesses maintaining multiple payment options, consumers understanding the value of payment diversity, and governments ensuring infrastructure resilience.

The approach creates a financial ecosystem capable of both withstanding major shocks and recovering rapidly – transforming resilience from a theoretical concept into operational reality. Europe’s recent blackouts have painfully demonstrated the fragility of digital systems when power and connectivity fail.

In our increasingly cashless society, the EU’s balanced vision – embracing digital innovation while safeguarding traditional payment methods – has become not just prudent but essential. For when crises strike, what matters most isn’t technological sophistication, but the fundamental reliability of our payment infrastructure.

alexandra.paucescu@europe-diplomatic.eu